When you hear the words “right to life” you almost immediately think of courageous nonprofits like pregnancy resource centers where women who may be pregnant can make an informed choice. These centers are staffed by compassionate professional nurses and trained client consultants, usually faith-filled volunteers willing to advocate for both the woman and her unborn child, as well as for fathers and their families. Their loving concern is evident in situations that are often strained and confusing for the women experiencing an unplanned pregnancy.

Birthright Columbus on Skidmore Street is one of those centers. They are always free for clients, and rely solely on donations. They look to generous supporters to provide the all important material goods that fly out the door daily—boxes of disposable diapers, maternity clothing for moms, and every conceivable product for newborns from onesies to fuzzy blankets. Outright gifts of cash and goods to Birthright are crucial to their survival.

On East Dublin Granville Road in Columbus there’s another organization, the Greater Columbus Right to Life, whose mission is to promote a culture that protects human life (not just pre-born babies) from conception until natural death. In addition to their work to end abortion, embryonic stem cell research, euthanasia, and physician-assisted suicide, they also work to protect religious freedom and rights of conscience.

Both nonprofit organizations rely on donations to sustain their mission, and both are effective at reaching out to like-minded donors who give what they can to help keep doors open. What is more difficult to attract, but have larger impact, are the large transformational gifts needed for long-term planning, growth, and director salaries. For those donors with unique wealth, tax, income, and/or estate issues, giving can become truly transformational for both the giver and receiver, but also more complex.

There are life income gifts like the charitable gift annuity (CGA), the charitable remainder trust (CRT), the charitable lead trust (CLT), and the pooled income fund. When properly executed, these methods often satisfy estate and tax issues for donors.

Bequests can be as simple as placing a paragraph of instructions in a will, or adding a specific charity to their IRA or life insurance policy. Family foundations allow donors to keep their gifted capital intact while they make smaller annual charitable distributions.

These methods for charitable giving require a level of sophistication to fully understand and implement. Some require the help of an accountant, tax advisor, wealth planner advisor, and others. We recommend that if you are seeking, or merely curious, about methods for transformational charitable gifts, that you seek independent, objective advice about the legal, tax, and financial implications appropriate to your situation.

Should you consider Birthright of Columbus or The Greater Columbus Right to Life organizations for your gift, we hope that you will look to the Stewardship Foundation to lead the conversation.

NOTE: Stewardship Foundation is an underwriting sponsor for the Annual Banquet benefitting the work of Greater Columbus Right to Life taking place on Monday, June 13, 2016, at the Lausche Building, Ohio Expo Center, Columbus. You can learn more here.

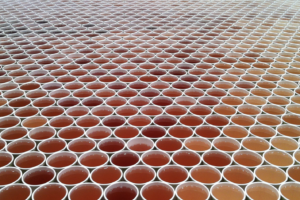

A handful of religious groups including the United Church of Christ and the two largest American Jewish movements, Reform and Conservative, all favor a woman’s right to have an abortion with few or no exceptions. (Pew Research) One artist, Belo, to raise awareness about the clean water crisis, created an image made from 66,000 cups of colored rainwater simulating levels of impurities found in water from all over the planet. His goal may have been to dramatically inform us of the consequences of a lack of drinkable water, but he’s also touched the hearts of many who oppose abortion for any reason.

A handful of religious groups including the United Church of Christ and the two largest American Jewish movements, Reform and Conservative, all favor a woman’s right to have an abortion with few or no exceptions. (Pew Research) One artist, Belo, to raise awareness about the clean water crisis, created an image made from 66,000 cups of colored rainwater simulating levels of impurities found in water from all over the planet. His goal may have been to dramatically inform us of the consequences of a lack of drinkable water, but he’s also touched the hearts of many who oppose abortion for any reason.